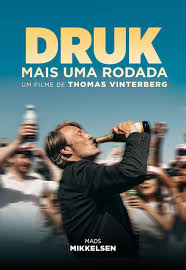

Winter it seems, across much of Europe, has come early. Two instincts that grow as the evenings darken are the inclination to have a tipple in the evening and to watch a good film. One Danish work that captures both sentiments is ‘Druk’ or ‘Another Round’, which won the Oscar for best international film in 2021. I recommend it.

In the film a group of four school teacher friends decide to test the hypothesis of a Norwegian psychologist that humans have a deficiency of alcohol in their blood, and the protagonists undertake an experiment to maintain a ‘warm’ level of alcohol in their blood. It is an experiment I attempt often, but the real lesson today is with central banking.

It seems that central bankers have decided that in the spirit of ‘Druk’, the liquidity in the world financial system is not sufficient and have set out to administer near daily injections of cheap money. The number of central banks changing policy (i.e. to negative) is the greatest it has been, apart from the global financial crisis and the COVID period. In September alone there have been 24 rate cuts from central banks around the world.

Chief amongst these has been the 50-basis point cut from the Federal Reserve and the very dramatic, multiple policy moves by China. In short China has cut rates, infused the banking system, made mortgages cheaper and generally tried to spread liquidity over the emerging cracks in China’s economy. In the spirit of ‘Druk’ it is the equivalent of going on a five day bender in order to cure a serious disease.

Nonetheless, the easing in policy from the Fed and China, together with what will likely be a couple of more rate cuts this year from the European Central Bank mean that the world financial system is flush with liquidity. Chinese markets – hitherto the worst performing markets of a major economy – show the impact and importance of liquidity. The market cap of the Hang Seng index has grown by a quarter in less than two weeks. China has overtaken the US in terms of equity market performance to date.

There is no change to fundamentals – I don’t see this policy move having a decisive impact on the downward trend in Chinese earnings, but that doesn’t matter in the near term – liquidity is coursing through the pipes of the Chinese financial system, and in turn might bring a temporary easing to conditions in the property market.

For all the analysts who devote time to measuring earnings and calibrating valuations, the reality is that in this era of ‘quick to please’ monetary policy, liquidity matters a lot for asset prices. My rule of thumb in constructing a measure of liquidity would encompass money supply, the state of central bank balance sheets, the key role of the dollar and net issuance of debt by treasuries.

The arcane notion of financial liquidity has attracted enough attention that the Financial Times recently ran an article breaking down its component parts. A couple of top-flight economics consultancies run their own measures of liquidity – such as LongView Economics and Michael Howell at CrossBorder Capital. The latter holds that we are on the cusp of a significant upswing in global liquidity.

If that is true, the implication for markets is ‘Druk’- a persistent giddyiness whilst central banks keep rates low and liquidity flush, amidst an acceptable level of GDP and profit growth. Friday’s job market figures in the US were very strong, suggesting that in fact there was no need for a large rate cut. This is the kind of macro climate we have seen in the mid and late 1990’s, and one that tends to dampen the market implications of turbulent geopolitics.

From the point of view of asset prices, there are a couple of possible trajectories. Historically, the Fed has started to cut interest rates when the price to earnings ratio on the S&P 500 has been close to 10 times (1960’s to 1990’s). Now, like in 2000, it is in the mid 20’s which suggests that extra liquidity now could run asset prices in bubble territory proper, and cultivate the next bout of inflation, something the central banks’ bank, the BIS, has warned about (helpfully the BIS has taken a counter view to that of its members ahead of a number of crisis).

For the time being, the upturn in liquidity may be most meaningful for capital markets activity and assets in the private economy. They have been in the doldrums. If the ‘Druk’ hypothesis is working we should see a rise in IPO activity into 2025, and intensification in private equity deals and a rise in funding activity (beyond AI firms) in venture.

Then, later in 2025, the hangover will arrive.

Have a great week ahead,

Mike